The amount that Sean borrowed at 7.5% per year, compounded annually, for which he paid $2,244.92 after three years is $1,807.07.

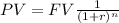

We can use the present value Formula:

PV = present value

FV = future value

r = rate of return

= number of periods

= number of periods

We can determine the present value using an online finance calculator as follows:

N (# of periods) = 3 years

I/Y (Interest per year) = 7.5%

PMT (Periodic Payment) = $0

FV (Future Value) = $2,244.92

Results:

PV (present value) = $1,807.07

Total Interest= $437.85