Suppose that Company A currently trades for $75.60 and the 3-month risk free rate is 4%. The price of a three-month put option on Company A with a strike price of $80 is: E. $7.51.

What is the price?

Given data:

- Current stock price (S) = $75.60

- Risk-free rate (r) = 4%

- Call option price (C) = $3.91

- Strike price (X) = $80

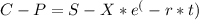

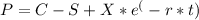

Put-Call Parity formula:

Plugging in the values:

P = $3.91 - $75.60 + $80 * e^(-0.04 * 3/12)

P = $3.91 - $75.60 + $80 * e^(-0.01)

P = $3.91 - $75.60 + $80 * 0.9900

P = $3.91 - $75.60 + $79.2

P = $3.91 + $79.2 - $75.60

P = $7.51

Therefore the price of a three-month put option on Company A with a strike price of $80 is: E. $7.51.