Isaiah contributed a total of $90,000 himself by saving $500 per month for 15 years.

Isaiah made a total of $166,405.21 through compounded returns in this investment account.

How is that so?

Total amount contributed by Isaiah:

Monthly contribution: $500

Years of contribution: 15 years

Total contribution = monthly contribution * 12 months/year * years of contribution

Total contribution = $500/month * 12 months/year * 15 years

Total contribution = $90,000

Compounded returns:

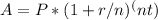

We can use the compound interest formula to calculate the compounded returns:

where:

- A is the final amount

- P is the principal amount (total contribution)

- r is the annual interest rate (7%)

- n is the number of times compounded per year (12 for monthly)

- t is the number of years (15)

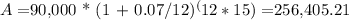

In this case, we have:

P = $90,000

r = 7%

n = 12

t = 15

Therefore, the final amount is:

The compounded returns are the difference between the final amount and the total contribution:

Compounded returns = A - P = $256,405.21 - $90,000 = $166,405.21