The Loan will have a lower balance by 70.47 at the time of repayment.

How to Identify the best loan offer?

To determine which loan will have a lower balance at the time of repayment, we need to calculate the total amount of interest that will be accrued on each loan.

1) For the unsubsidized Stafford loan:

The loan amount is $3,725.

The annual interest rate is 4.65%, compounded monthly. This means the monthly interest rate is 4.65%/12 = 0.3875%.

The loan will be repaid in 6 months, so there will be 6 monthly compounding periods.

Using the formula for compound interest, the balance of the loan at the time of repayment will be:

balance = principal x (1 + monthly interest rate)^number of compounding periods

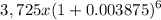

balance =

balance = 3,901.95

So the balance of the unsubsidized Stafford loan at the time of repayment will be 3,901.95.

2) For the PLUS loan:

The loan amount is 3,725.

The annual interest rate is 5.65%, compounded monthly. This means the monthly interest rate is 5.65%/12 = 0.4708%.

The loan will be deferred until graduation, which is in 6 months, so there will be 6 monthly compounding periods.

Using the formula for compound interest, the balance of the loan at the time of repayment will be:

balance = principal x (1 + monthly interest rate)^number of compounding periods

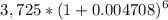

balance =

balance = 3831.47

So the balance of the PLUS loan at the time of repayment will be 3831.47

Difference in balance = 3,901.95 - 3831.47

= 70.47

Therefore, the PLUS loan will have a lower balance at the time of repayment, by an amount of 70.47