Count the number of months it takes to reach

. This will be the number of months it takes to pay off the debt. By doing so, we get that It takes 5 months to pay off the debt.

. This will be the number of months it takes to pay off the debt. By doing so, we get that It takes 5 months to pay off the debt.

To determine in how many months the debt will be paid off, we can use a spreadsheet or a loop to simulate the monthly payments and interest accumulation until the debt is fully paid.

Let's denote the following variables:

- P = principal amount (initial debt)

- r = monthly interest rate (APR / 12 / 100)

- n = number of months

- A = monthly payment

Given:

- P = $1,853.42

- r = 15.5\% / 12 / 100

- A = $400.00 for the first two months, then A = $200.00

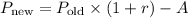

The formula to calculate the remaining balance after each monthly payment is:

![\[ P_{\text{new}} = P_{\text{old}} * (1 + r) - A \]](https://img.qammunity.org/2024/formulas/mathematics/high-school/5bsycsuladogqy4a853gcoo0vey2ezu2cm.png)

Here's the calculation:

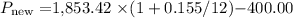

1. For the first two months:

-

-

-

Repeat this for the second month using the new balance.

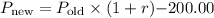

2. For the subsequent months:

-

- Repeat this until

Count the number of months it takes to reach

. This will be the number of months it takes to pay off the debt. By doing so, we get that It takes 5 months to pay off the debt.

. This will be the number of months it takes to pay off the debt. By doing so, we get that It takes 5 months to pay off the debt.

The probable question may be: "You owe $1,853.42 on a credit card with a limit of $3,000.00 at a rate of 15.5% APR. You pay $400.00 the first 2 months and then $200.00 until the bill is paid off. You pay the bill on the due date each month.In how many months the debt is paid off?"