Answer:

The following summarizes the solution to the given problem.

Step-by-step explanation:

The given values are:

Sales,

= $660,000

Expenses,

= $255,453

Received cash revenues,

= $605,934

(a)

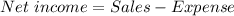

According to the accrual, profits would be acknowledged and therefore not necessarily received on the occasion of purchase.

⇒

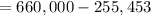

On substituting the given values, we get

⇒

⇒

($)

($)

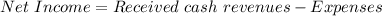

(b)

⇒

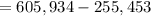

On substituting the given values, we get

⇒

⇒

($)

($)

(c)

- The reliable financial foundation again for a financial consultant is more helpful because it demonstrates or represents the organization's appropriate financial status.

- It accepts the profits throughout a similar time frame.