a. The loan balance after the grace period is $17,226.25.

b. The new monthly payment is $206.03.

c. The amount saved by refinancing is the difference between the total payments made with the original loan and the total payments made with the new monthly payment.

a. To find the loan balance after the grace period, we need to calculate the total balance for each year and then add up the balances for all four years.

For freshman year:

Loan amount: $4000

Interest rate: 1% compounded quarterly

Time in school: 3/4 year

Balance after interest for freshman year: $4000 *

= $4090

= $4090

For sophomore year:

Loan amount: $3500

Interest rate: 1% compounded quarterly

Time in school: 1 year

Balance after interest for sophomore year: $3500 *

= $3571.25

= $3571.25

For junior year:

Loan amount: $4400

Interest rate: 1% compounded quarterly

Time in school: 1 year

Balance after interest for junior year: $4400 *

= $4484.40

= $4484.40

For senior year:

Loan amount: $5000

Interest rate: 1% compounded quarterly

Time in school: 1 year

Balance after interest for senior year: $5000 *

= 5080.60

= 5080.60

Now, let's calculate the balance after the grace period:

Loan balance after grace period = balance after freshman year + balance after sophomore year + balance after junior year + balance after senior year

Loan balance after grace period = $4090 + $3571.25 + $4484.40 + $5080.60 = $17,226.25

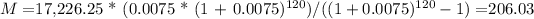

b. To find the new monthly payment, we can use the loan balance after the grace period and calculate the monthly payment using the formula for a loan payment.

Loan balance after grace period: $17,226.25

Interest rate: 3% compounded quarterly

Time: 10 years (120 months)

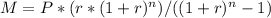

Monthly payment formula:

where M is the monthly payment, P is the loan balance, r is the monthly interest rate, and n is the number of months.

Monthly interest rate: 3% / 4 = 0.75%

Monthly payment:

c. To find the amount saved by refinancing, we need to calculate the total payments made with the original loan and compare it to the total payments made with the new monthly payment.

Original loan term: 10 years (120 months)

Original monthly payment: $206.03

Total payments made with the original loan: $206.03 * 120 = $24,723.60

Amount saved by refinancing = Total payments made with the original loan - Total payments made with the new monthly payment

Amount saved by refinancing = $24,723.60 - ($206.03 * 120)