Answer:

Step-by-step explanation:

From the given information, the ratio analysis for the year 2017 at OHARA Company can be computed as follows:

1. Working capital = Current (assets - liabilities)

Working capital = $458900 - $195500

Working capital = $263,400 (for 2017)

Given that the working capital for 2016 = $160,500

Thus, the % increase of 2017 over 2016 = 64.11% increase.

2. Current ratio = Current assets / Current liabilities

Current ratio = 458,900/195,500

Current ratio = 2.35 (for 2017)

Given that the Current ratio for 2016 = 1.65

Thus, the % increase of 2017 over 2016 = 42.43% increase

3. Free cash flows = Operating cash flows - Capital expenditure - dividends

Free cash flows = $190800 - $92000 - $31000

Free cash flows = $67,800

Given that the free cash flow for 2016 = $48,700

Thus, the % increase of 2017 over 2016 = 39.22%

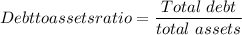

4.

Debt to assets ratio = 395,500/10,34,200

Debt to assets ratio = 38.24%

Given that the debt to assets ratio for 2016 = 31%

Thus, the % increase of 2017 over 2016 = 23.35%

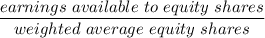

5.

Earnings per share =

Earnings per share =

Earnings per share = $3.06

Given that the earnings per share = $3.15

Thus, the % decrease of 2017 over 2016 = 2.86%