Solution :

1. This is not a loss contingency as extended warranty is being priced as well sold separately from warranted products and therefore constitutes the separate sales transaction.

2.

Event General Journal Debit Credit

1 Cash $412,000

Unearned revenue -- extended warranties $412,000

2. Unearned revenue -- extended warranties $ 57937.50

Revenue - Extended Warranties $ 57937.50

Working :

The manufacturer provided 90 days which is 3 months of free warranty. Thus a customer who is purchasing the extended warranty is for 09 months.

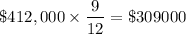

Now amount received by Carnes Electronics for the extended warranty in one year = $412,000

So,

of sales.

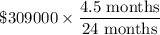

of sales.

The warranty is for two years and so 4.5 months in one year.

Therefore the revenue earned on the extended warranty is :

= $ 57937.50