Problem 3

Answer: 4 compounding periods per year

In other words, the money is being compounded quarterly

===========================================================

Step-by-step explanation:

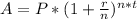

The compound interest formula is

The variables are

- A = final amount after t years

- P = initial deposit, aka principal

- r = interest rate in decimal form

- n = number of compounding periods per year

- t = number of years

In this case, we have

- A = 104,070.70

- P = 100,000

- r = 0.02

- n = unknown (what we want to solve for)

- t = also unknown, but we do know that n*t = 8 because this represents the number of total compounding periods.

So,

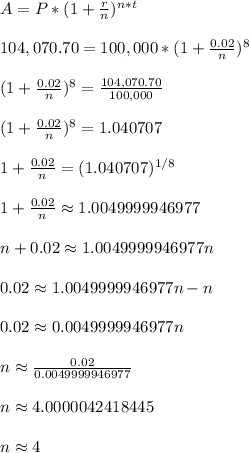

So it appears that we're compounding the money n = 4 times a year (aka quarterly) and doing so for 8/4 = 2 years.

Note how,

which helps confirm the answer.