The Net Present Value (NPV) of the project, considering an initial investment of $1 million and 11 payments of $0.3 million over 11 years with a 7% cost of capital, is $1,992,200.

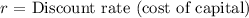

The formula for NPV is:

![\[ NPV = \sum_(t=0)^(n) \frac{{CF_t}}{{(1 + r)^t}} - Initial Investment \]](https://img.qammunity.org/2024/formulas/business/high-school/glo6nm2gli7qj8z2fhcsn64l0s5xtke5ts.png)

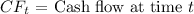

Where:

Given:

Initial investment = $1 million

Cash flow per period = $0.3 million for 11 years

Discount rate (cost of capital) = 7%

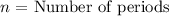

calculate the NPV:

![\[ NPV = -1,000,000 + \sum_(t=1)^(11) \frac{300,000}{{(1 + 0.07)^t}} \]](https://img.qammunity.org/2024/formulas/business/high-school/8hi1fg2rivrxva9ptdf6qsdizoegys4nt8.png)

![\[ NPV = -1,000,000 + 300,000 * \left( (1 - (1 + 0.07)^(-11))/(0.07) \right) \]](https://img.qammunity.org/2024/formulas/business/high-school/bd53bxwwrrthdt568ty6rn2lqoqky856rn.png)

Calculating this:

![\[ NPV = -1,000,000 + 300,000 * \left( (1 - 0.5084)/(0.07) \right) \]](https://img.qammunity.org/2024/formulas/business/high-school/kvrxr17sn4qr2svfgp6ackis6t7tw0hmhv.png)

![\[ NPV = -1,000,000 + 300,000 * 9.974 \]](https://img.qammunity.org/2024/formulas/business/high-school/brzqizv69lx06z1avh4xyoh6ugk1sy3e02.png)

![\[ NPV = -1,000,000 + 2,992,200 \]](https://img.qammunity.org/2024/formulas/business/high-school/ilcnzeokr4bap5kyozikwzw68fh9yx63o6.png)

![\[ NPV = 1,992,200 \]](https://img.qammunity.org/2024/formulas/business/high-school/dhfeo2b9a67l02ozm6li34ozyu8avqv1bl.png)

Therefore, the Net Present Value (NPV) of this project, given a 7% cost of capital, is $1,992,200.