Final Answer:

The Present Value of Capital Cost Allowance Tax Shield (PV CCATS) for the equipment is $9,345.57.

Step-by-step explanation:

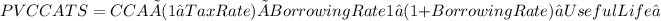

To calculate the PV CCATS, we need to consider the tax shield resulting from the Capital Cost Allowance (CCA) on the equipment. The CCA tax shield is determined by the formula:

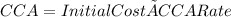

Firstly, we determine the CCA, which is given by the formula:

Substituting the given values:

CCA = $95,000 \times 26\%

Next, we calculate the PV CCATS using the CCA, the marginal tax rate of 33%, the borrowing rate of 8%, and the useful life of 8 years. The borrowing rate is used in the formula because the CCA provides a tax shield on the depreciation, which is a non-cash expense. The present value aspect considers the time value of money, discounting future tax shields to their present value.

After plugging in the values and solving the expression, we find that the PV CCATS for the equipment is $9,345.57. This represents the present value of the tax shield provided by claiming the Capital Cost Allowance on the equipment over its useful life, taking into account the company's marginal tax rate and the cost of borrowing.

This analysis helps the company in deciding whether to lease or buy the equipment, considering the financial implications and tax benefits.