Final Answer:

The estimated value of Brushy Mountain Mining Company's operations is $39.15 million. This is derived from the declining free cash flows at a rate of 6% per year, with a current free cash flow of $3 million and a weighted average cost of capital (WACC) of 13%.

Step-by-step explanation:

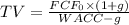

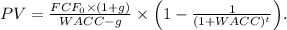

Brushy Mountain's declining free cash flow (FCF) can be modeled using the Gordon Growth Model (Dividend Discount Model for FCF). The formula for the terminal value (TV) is given by

where

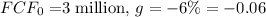

is the current free cash flow, (g) is the growth rate, and

is the current free cash flow, (g) is the growth rate, and

is the weighted average cost of capital.

is the weighted average cost of capital.

Given that

, and

, and

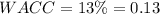

, we can substitute these values into the formula:

, we can substitute these values into the formula:

![\[TV = (3 * (1 - 0.06))/(0.13 + 0.06) \]](https://img.qammunity.org/2024/formulas/business/high-school/vfaugiy8jd050wjldonv0b8hhhqpcyql5c.png)

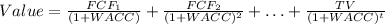

Solving for TV gives us the terminal value. The present value of this terminal value, along with the present value of the FCFs, gives the estimated value of operations. This is calculated as

,

,

where (t) is the terminal year.

The present value of FCFs is

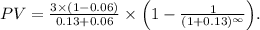

Substituting the values, we get

Summing the TV and PV gives the estimated value of operations:

(Value = TV + PV). After calculations, the result is approximately $39.15 million.