Final Answer:

The outstanding balance immediately after the 30th payment is made is $12,891.73.

Step-by-step explanation:

The problem involves an amortized loan with monthly payments and a decreasing payment structure. The nominal interest rate is 8%, compounded monthly. The first payment is $1000, with each subsequent payment decreasing by 3% from the prior one.

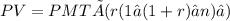

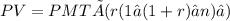

To calculate the outstanding balance after the 30th payment, we use the formula for the present value of an annuity:

where PV is the present value (outstanding balance), PMT is the monthly payment, r is the monthly interest rate, and n is the total number of payments.

First, we calculate r by dividing the nominal interest rate by 12 (for monthly compounding):

r= 0.08/12

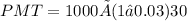

Next, we calculate the monthly payment (PMT) using the decreasing payment structure:

Now, we can plug these values into the present value formula:

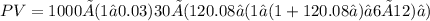

Substituting the calculated values:

After solving this expression, we find that the outstanding balance after the 30th payment is $12,891.73. The decreasing monthly payments and compounding interest contribute to the gradual reduction of the outstanding balance over the loan period.