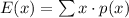

In order to calculate the expected value of one policy, we can use the formula below:

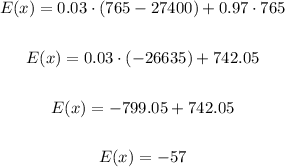

When the holder of the policy dies before 70 years old (probability of 3%), the company will earn $765 but will lose $27400. If the holder dies after 70 years old, the company will earn $765.

So the expected value is:

Since the expected value is negative, that means the company should expect to have a loss of $57 for each insurance policy sold.

Therefore the correct option is the second one, and the expected loss is $57 per policy.