Based on the future value of Isabel's savings account ($8,912.68), the cars within Isabel's budget are:

Choice 1: with a down payment of $8,500

Choice 2 with a down payment of $6,200

Choice 3 with a down payment of $5,100

Choice 4 with a down payment of $7,250

Choice 5 with a down payment of $7,750

Choice 6 with a down payment of $7,500

How to determine which cars are within Isabel's budget

To determine which cars are within Isabel's budget, calculate the future value of her savings account after 15 months, considering the monthly transfer of $200 and the interest rate of 1.70% compounded monthly.

Then, compare this future value to the down payments for each car.

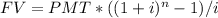

Let's calculate the future value (FV) of Isabel's savings account after 15 months using the formula for compound interest:

Where:

i = r/12

n = 15

Since the bank transfers $200 from Isabel's checking account to her savings account on the 15th of every month, consider the transfers as the initial savings account balance (PV). The interest rate per month (r) is 1.70% or 0.017 in decimal form. The number of compounding periods (n) is 15 (as there are 15 months).

Let's calculate the future value (FV) of Isabel's savings account after 15 months:

i = 1.7/12 = 0.142

FV = 200 * [(1 + 0.142)^15 - 1] / 0.142

FV ≈ 200 * [7.328 - 1] / 0.142

FV ≈ 200 * 6.328 / 0.142

FV ≈ $8,912.68

The future value of Isabel's savings account after 15 months is approximately $8,912.68

Now, compare the down payments for each car with the future value of Isabel's savings account:

Choice 1: Down payment $8,500 - Within Isabel's budget

Choice 2: Down payment $6,200 - Within Isabel's budget

Choice 3: Down payment $5,100 - Within Isabel's budget

Choice 4: Down payment $7,250 - Within Isabel's budget

Choice 5: Down payment $7,750 - Within Isabel's budget

Choice 6: Down payment $7,500 - Within Isabel's budget

Based on the future value of Isabel's savings account ($8,912.68), the cars within Isabel's budget are:

Choice 1: with a down payment of $8,500

Choice 2 with a down payment of $6,200

Choice 3 with a down payment of $5,100

Choice 4 with a down payment of $7,250

Choice 5 with a down payment of $7,750

Choice 6 with a down payment of $7,500

These are the cars that Isabel can afford based on her savings account balance and the given down payments.

On the 15th of every month, the bank transfers $200 from Isabel's checking account to her savings account. The interest on her savings account is 1.70% compounded monthly. Isabel is shopping for her new car. She identified 6 models she likes at a local dealership. The table lists the down payment she would need to make on each car to keep the monthly payment within her budget. Assume that she's using only the money accumulated in her savings account to make the down payment. Use this information and the appropriate time value of money formula to select all the cars that are within Isabel's budget?

choice 1 down payment $8.500

choice 2 down payment: $6,200

choice 4 down payment $7 250

choice 5 down payment: $7.750

choice 3 down payment $5,100

choice 6 down payment $7 500