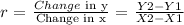

We know that the rate of change is a rate that describes how one quantity changes in relation to another quantity. If x is the independent variable and y is the dependent variable, then

where (X1,Y1) and (X2,Y2) are points of our model.

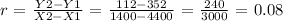

So, in this case we have that:

So, the correct answer is: the rate of change for the sales tax is $0.08 per dollar.