Explanation:

Given

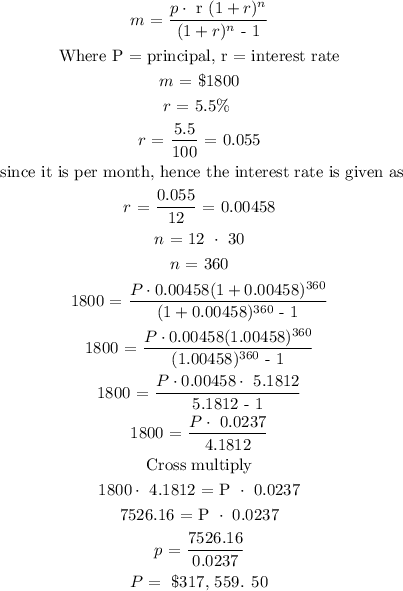

Principal = $1,800

interest rate = 5.5%

Using the below formula to calculate the mortgage

Hence, the loan he can afford is $317, 559. 50

Part B

The total money he will pay to the bank is calculated as follows

Total amount = 1800 * 360

Total amount = $648, 000