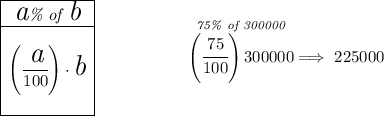

so hmmm 25% of that 300,000 is going as a downpayment, so he need the loan for the remaining 75% of that hmmm

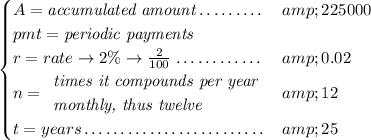

so for that much, so since he'll be making monthly payments, the compounding period will be monthly, now, we're assuming the payments are at the end of each month.

![~~~~~~~~~~~~\underset{\textit{payments at the end of the period}}{\textit{Payments of an ordinary annuity}} \\\\ pmt=A\left[ \cfrac{(r)/(n)}{\left( 1+(r)/(n) \right)^(nt)-1} \right]](https://img.qammunity.org/2024/formulas/mathematics/college/10zw85f13xc0ueppn4jkwfuyzd1fu4zahx.png)

![pmt=225000\left[ \cfrac{(0.02)/(12)}{\left( 1+(0.02)/(12) \right)^(12 \cdot 25)-1} \right] \\\\\\ pmt=225000\left[ \cfrac{(1)/(600)}{\left( (601)/(600) \right)^(300)-1} \right]\implies pmt\approx 578.67](https://img.qammunity.org/2024/formulas/mathematics/college/bi6mipry36jwd8z1o67p9tvn24bq59y7cz.png)