Answer:

The correct solution is "$6,564.01". A further solution is given below.

Step-by-step explanation:

The given values are:

beta,

= 1.6

market return,

= 15%

cash flow,

= $2,000

risk free rate of interest,

= 3%

Now,

The stock return will be:

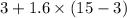

=

=

=

The actual worth of the firm will be:

=

=

=

=

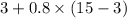

With 0.8 beta, the stock return will be:

=

=

=

So that I'm paying for the firm,

=

=

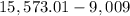

=

($)

($)

Hence,

I'm paying,

=

=

($)

($)