Answer:

Internal rate of Return = 17%

Step-by-step explanation:

Solution:

In order to solve this question, there are two methods to solve. First one is through the use of Factor Tables values, which is bit lengthy. And Second one is through the use of Excel.

Here, I will be solving through the use of Factor Tables.

Using Factor Tables Method:

First we need to know the formula to calculate the interest rate:

P = A x

From the above formula, we need to find the P/A.

P/A =

Where, P = $800,000

A = $250,000

So, the P/A = 3.2

Now, you need to check out the factor tables for the value interest rate against the value of P/A 3.2 for 5 years.

You will get interest rate of 16% for P/A 3.2743 for 5 years,

And

You will get interest rate of 18% for P/A 3.1272 for 5 years.

But, our P/A value is 3.2 only and it lie between these two points.

So, now, we need to find the internal rate of return which will be our correct answer.

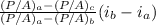

Internal Rate of Return =

+

+

Where,

= 18% = 0.18

= 18% = 0.18

= 3.1272

= 3.1272

= 16% = 0.16

= 16% = 0.16

= 3.2743

= 3.2743

By plugging in the values, we will get the internal rate of return.

Internal rate of Return = 0.170

Internal rate of Return = 17%