To find the forward rate, multiply the spot rate by the interest rate ratio and factor in the time until expiration.

The interest rate on a two-year bond purchased a year from now is 9.058%.

As a result, the forward rate equals the spot rate multiplied by (1 + domestic interest rate) / (1 + foreign interest rate).

Latasha will select Strategy B if the two-year bond purchase one year from now pays 6% annually.

This is because a 3-year return of 7% outperforms returns of 3%, 6%, and 6%.

In theory, the forward rate should equal the spot rate plus any security earnings (and any finance charges).

This principle can be seen in equity forward contracts, where the difference between forward and spot prices is based on dividends payable, less interest payable during the forward period.

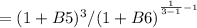

Forward Rate formula

=

![[((1+S1)n^(1) )/((1+S2)n^(2) ) ]^{(1)/((n1-n2)) } -1](https://img.qammunity.org/2024/formulas/business/college/thcrl63xt0px4xvxmv09ftrcedqk228ma8.png)

Now, 3year bond rate S1 is7%

1 year bond rate S2 is 3%

3v5 Forward rate

= 9.058%