GIVEN:

We are told that a customer borrowed $2000 and then $1000 both at the rate of 10% for 1 year.

Required;

To determine how much he would have saved if he had taken a loan of $3000 at the rate of 8% for 1 year instead.

Step-by-step solution;

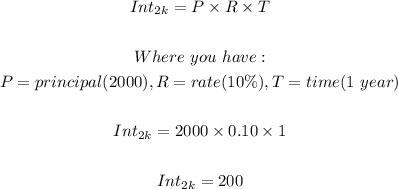

We will calculate the interest charged on the loans of $2000 and $1000 as follows;

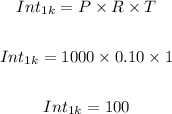

Also, we have;

This means the interest payable on both loans will be $300 (200 + 100).

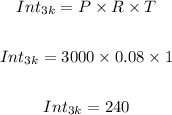

To determine the amount of interest payable on the loan of $3000;

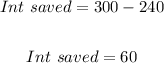

Observe that the customer would be paying less if he had taken one sum of $3000 at the rate of 8%, and therefore the amount he would have saved is;

ANSWER:

Option A is the correct answer. The customer would have saved $60