Answer:

Explanation:

All four cases deal with compound interest on the same amount of $500 and same interest rate of 2%.

The only difference is in the frequency of compounding and time

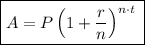

Compound Interest Formula

where

- P = amount initially deposited - principal amount

- A = accrued value which is principal amount + interest

- r = interest rate expressed as a decimal

- n = number of compounding intervals.

This will depend on the frequency of compounding - daily, monthly, quarterly or yearly

- t = number of number of years under consideration

In this particular problem we have

P = $500

r = 2% = 0.02

These are common for all parts of the question

Only n an t are different for each of the question sub-parts

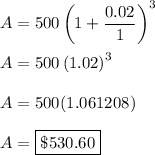

Part a

Compounding is done annually (once a year) for 3 years

n = 1

t = 3 years

n · t = 3

For accuracy of calculations, I will not compute and store the exponent part, I will perform the calculations in one shot

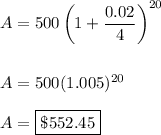

Part b

Here the compounding is done quarterly (4 times a year) for 5 years

n = 4

t = 5 years

nt = 4 · 5 = 20

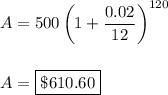

Part c

Compounding done monthly(12 times a year) for 10 years

n = 12

t = 10

nt = 120

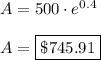

Part d

First let's figure out what continuous compounding means

![\fbox{\begin{minipage}[t]{1\columnwidth \fboxsep - 2\fboxrule}%\textsf{What is continuous compounding?} \\\textsf{Continuous compounding is the mathematicallimit that compound interest can reach if it's calculated and reinvestedinto an account's balance over a theoretically infinite number ofperiods. While this is not possible in practice, the concept of continuouslycompounded interest is important in finance. (Investopedia)}\}%\end{minipage}}]()

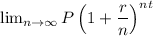

The formula for continuous compounding can be determine by using the standard formula for periodic compounding and taking limits as

Therefore, for compounding continuously , the formula can be derived from

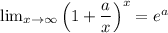

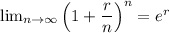

One of the limit formulas states

Therefore

So for the continuous compounding case, the formula is

Here we have

r = 0.02

t = 20 years

rt = 20(0.02) = 0.4

Plugging in P = 500, and rt = 0.4 we get