Given:

There are given the total amount to buy a home $182000.

Step-by-step explanation:

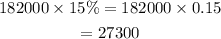

From the given question, there are saying that the 15% as a down payment

Then,

The total amount that pays as a down payment.

So,

Then,

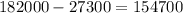

Subtract the above amount from the total amount:

So,

(a):

The total loan amount is $154700.

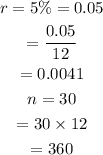

(b):

The total loan amount is 182000.

The total number of periods is 30.

The interest rate per period is 5%.

So,

For calculating the monthly payment:

Divide the given rate by 12 and multiply the given period by 12.

So,

Now,

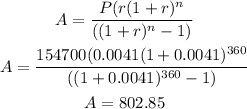

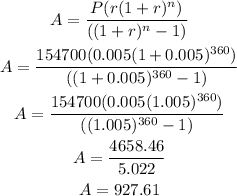

From the formula:

Then,

Put the all values into the above formula:

So,

The monthly payment is $802.85.

Now,

(c):

If the interest rate is 6%:

Then,

Final answer:

Hence, the answer of part (a), (b), and (c) are :

(a): $154700.

(b): $802.85

(c): $927.61