We have to calculate the monthly deposit in order to achieve a certain amount after certain number of years.

The amount is P = $210,000 and the number of years is n = 8 years.

Each deposit will increase a capital that will be compounding the interest, which has a annual rate of r = 10.2%.

As the deposits are made monthly (and we assume this is also the compounding period), we have a number of subperiods m = 12 subperiods per year.

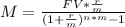

We can use the annuity formula to find the monthly payment M so as to have a future value of FV = 210000:

We can replace with the values and calculate the amount as:

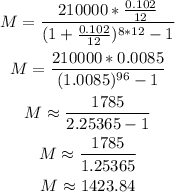

2) We have to calculate how much they deposit into the account.

As they deposit monthly during 8 years, the amount of deposits will be 12*8 = 96 deposits.

We can then multiply by the deposit amount and obtain:

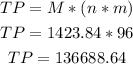

Answer:

1) Monthly payment = $1,423.84

2) $136,688.64