Given:

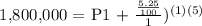

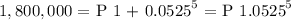

a.) A company will need 1.8 million 5 years from now to replace some equipment.

b.) The account pays 5.25 percent interest, compounded annually.

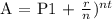

We will be applying the Compounded Interest Formula:

Where,

A=final amount

P=initial principal balance/money to initially deposit

r=interest rate (decimal)

n=number of times interest applied per time period

t=number of time periods elapsed (in years)

In this scenario, we are asked what is the amount of principal balance/initial deposit to make to get 1.8 million in 5 years.

Annually = n = 1

We get,

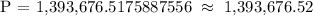

Therefore, the answer is 1,393,676.52