Answer:

Bianca need to pay $13.43 monthly to avoid interest capitalization.

Explanation:

Principal value = $2600

Time = 10 years = 120 months

Interest rate = 6.2% = 0.062

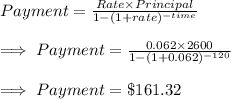

Now, Find amount of payment by using the formula :

Total payment is to be paid in 1 year :

Hence, Bianca need to pay $13.43 monthly to avoid interest capitalization.