The amount of income she earned was $143,028

Here, we are interested in getting the amount of income earned by Nikita last year

From the question, the amount of tax paid per $100 is $1.45

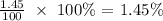

From here, we can get the percenatge of income that is meant for medicare

Mathematically, that would be;

What this mean is that 1.45% is paid to medicare per year

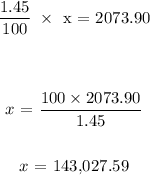

Hence, 1.45% of her total income last year is $2073.90

Let the amount of income earned be $x

Thus;

To the nearest dollars, the amount of income earned last year is $143,028