Answer:

The right solution is "$ 2.50 per DLH".

Step-by-step explanation:

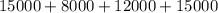

The given values are:

Rent,

= $ 15,000

Factor equipment's depreciation,

= $ 8,000

Indirect labor,

= $ 12,000

Production supervisor's salary,

= $ 15,000

Estimated DLHs,

= 20,000

The total manufacturing overhead will be:

=

On substituting the given values, we get

On substituting the given values, we get

=

=

($)

($)

Now,

The predetermined overhead rate will be:

=

=

($)

($)