Answer:

you should make investment B

Explanation:

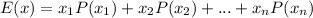

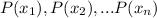

The expected value of a discrete variable is calculated as:

Where

are the possible values for the variable and

are the possible values for the variable and

are their respective probabilities.

are their respective probabilities.

Then, the expected value for investment A is:

E(A) = -20,000(0.25) + 0(0.5) + 80,000(0.25) = $15,000

Because, you can lose $20,000 with a probability of 0.25, you can break even with a probability of 0.5 or you can win $80,000 with a probability of 0.25.

At the same way, the expected value for investment B is:

E(B) = -50,000(0.3) + 0(0.5) + 180,000(0.2) = $21,000

Then, you should make investment B because the expected value for investment B is bigger than the expected value for investment A.