Money offered to Michelle per annum in Job A = $1700

Number of years she will work in job A = 5

Percentage of earnings per annum for her retirement plan = 6.60%

Money she will earn will be the simple interest at the end of 5 years.

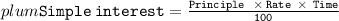

We know that :

Principal = $1700

Rate = 6.60%

Time = 5 years

Which means :

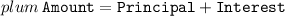

We also know that :

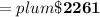

Amount Michelle will earn at the end of 5 years for her retirement plan :

2261 can be rounded off to 2260.

Therefore, Michelle will earn $2260 at the end of 5 years for her retirement plan.