Using the sum of the years digits method

Step 1:

We sum up all the digits of the estimated life of equipment.

i.e. 1 + 2 + 3 + 4 + 5 + 6 + 7 + 8 + 9 + 10 + 11 + 12 + 13 + 14 + 15 + 16 + 17 + 18 + 19 + 20 = 210

Step 2:

We count the years spent from the back. i.e. year 2 is equivalent to 19 in the years digits.

Given that the cost of the equipment is $79,600.00 with a salvage value of $4,000.00. This means that the depreciable amount of the equipment is given by $79,600.00 - $4,000.00 = $75,600.00

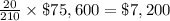

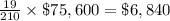

The depreciation charge on the equipment for year 1 is given by

while the depreciation charge on the equipment for year 2 is given by

The book value of an equipment is given by the cost of the equipment minus the accumulated depreciation.

Therefore, the book value of the equipment at the end of year 2 is given by

$79,600 - $7,200 - $6,840 = $65,560