Given that a taxpayer income is $151,000

It can be observed that the taxpayer is married filing jointly.

The income of the taxpayer falls between $80,250 to $171,050

The tax rate at this point is 22%

The standard deduction is $24,800

The taxable income can be calculated using the formula below

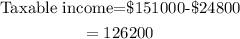

Using the above data, our taxpayer's taxable income is

It can be seen that the calculated taxable income is $126,200

The tax paid is calculated by the formula below

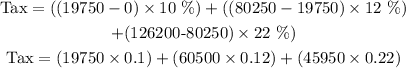

The tax that is required to be paid on the taxable income would be

Hence, the tax expected to pay is $19,344