ANSWER:

$22.68

Explanation:

Given:

Bracelet = $10

Markup percentage = 115% = 115/100 = 1.15

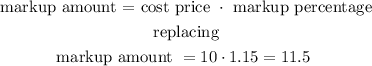

The markup amount can be calculated as follows:

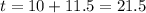

Therefore, the total price would be:

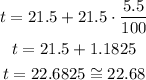

Now we apply sales tax for the price and calculate the price after tax, like this:

$22.68 is the total cost of the bracelet