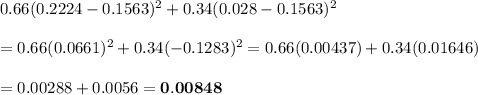

Given the following information:

![\begin{tabular} {|p{1.5cm}|p{1.5cm}|p{1.2cm}|p{1.2cm}|p{1.2cm}|} \multicolumn{1}{|p{1.5cm}|}{State of economy}\multicolumn{1}{|p{2.6cm}|}{Probability of State of economy}\multicolumn{3}{|p{4.8cm}|}{Rate of Return if State Occurs}\\[1ex] \multicolumn{1}{|p{1.5cm}|}{}\multicolumn{1}{|p{2.6cm}|}{}\multicolumn{1}c{Stock A}&StockB&Stock C\\[2ex] \multicolumn{1}{|p{1.5cm}|}{Boom}\multicolumn{1}{|p{2.6cm}|}{0.66}\multicolumn{1}{|p{1.27cm}|}{0.09}&0.03&0.34\\ \end{tabular}](https://img.qammunity.org/2018/formulas/mathematics/college/zsfrep8sn3o371w7f6sjgx5wf7l3tehxxt.png)

Part A:

The expected return on an equally weighted portfolio of these three stocks is given by:

![0.66[0.33 (0.09) + 0.33 (0.03) + 0.33(0.34)] \\ +0.34[0.33 (0.23) + 0.33(0.29) +0.33(-0.14)] \\ \\ =0.66(0.0297 + 0.0099 + 0.1122)+0.34(0.0759+0.0957-0.0462) \\ \\ =0.66(0.1518)+0.34(0.1254)=0.1002+0.0426=0.1428=\bold{14.28\%}](https://img.qammunity.org/2018/formulas/mathematics/college/4c21xoelpitrtam8jz5wgt48ikgelit4zn.png)

Part B:

Value of a portfolio invested 21 percent each in A and B and 58 percent in C is given by

For boom: 0.21(0.09) + 0.21(0.03) + 0.58(0.34) = 0.0189 + 0.0063 + 0.1972 = 0.2224 or 22.24%.

For bust: = 0.21(0.23) + 0.21(0.29) + 0.58(-0.14) = 0.0483 + 0.0609 - 0.0812 = 0.028 or 2.8%

Expected return = 0.66(0.2224) + 0.34(0.028) = 0.1468 + 0.00952 = 0.1563 or 15.63%

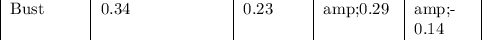

The variance is given by