Answer:

4 years ( Approx )

Explanation:

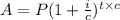

Since, the future value of an amount in credit card is,

Where, P is the initial amount,

i is the annual rate of interest,

c is the period of compounding,

t is the number of years,

For a credit card, generally we take c = 12 (monthly),

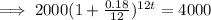

Here, P = $ 2,000,

i = 18 % = 0.18,

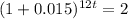

Let, the future value of the given amount after t years is $ 4000,

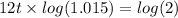

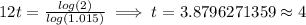

Taking log on both sides,

Hence, after approximate 4 years the balance on his credit card reached $4,000.