so, he paid 58.31 €, and that includes the 19% of VAT, well, if the price was hmmm say "x", then that means the price is say the 100%, and the the VAT gets slapped on top of it... so whatever "x" is, the VAT is 19% of that.

therefore, "x" + VAT, which is 58.31 €, is really the 100% + 19%, or 119% of "x".

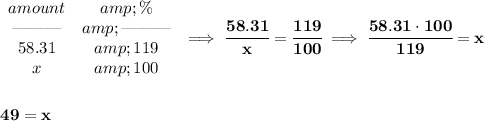

now if we know that 58.31 is 119%, and "x" is the 100%, what the dickens is "x"?

ahhha, so the original price of the calculator was 49 €, what's the VAT? well, 58.31 - x.