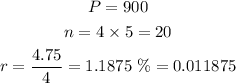

Given parameters

rate =4.75%

time= 5years

Annuity due refers to a series of equal payments made at the same interval at the beginning of each period. Periods can be monthly, quarterly, semi-annually, annually, or any other defined period.

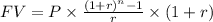

The formula to be used will be

From the question given

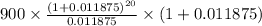

Part A

=> $97112.04

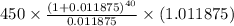

Part B

n=4x10 =40 (Because it is compounded 4 times a year and then for 10 years)

=>$61486.59