Answer:

The tax rate is 4%.

Explanation:

It is given that the property in Live Oak County is assessed at $250,000,000.

The total amount of tax raised on property is $10,000,000.

Let the tax rate be x%.

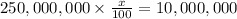

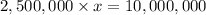

Since the rate of tax is x%, therefore x% of $250,000,000 is equal to $10,000,000.

Therefore the tax rate is 4%.