Given:

Birdie Brunella wants $5,000 at the end of each 3-month period for the next 6 years. If Birdie’s bank is paying 8% interest compounded quarterly.

We will find the initial deposit should be made now

so,

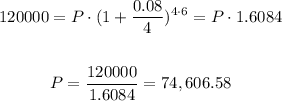

A = $5,000 * 6 * 12/3 = 120,000

Compunded quarterly, n = 4

Time = 6 years

interest rate = 8% = 0.08

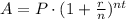

The compounded interest formula is:

so, the answer will be $74,606.58