In order to withdraw $30,000 per year for 25 years, you need to have:

This will be the future value.

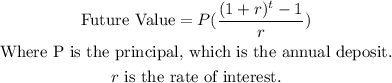

To figure the annual deposit, which plus annual interest would amount to $750,000, it is necessary to use the formula:

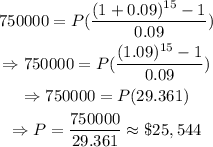

Substitute Future Value=$750,000, r=9%=0.09 and t=15 into the formula:

Hence, the annual deposit until retirement to achieve the goal is about $25,544.