Chuck has a gross pay of $815.70. His gross pay will be reduced by:

- Federal tax of $56;

- Social Security tax that is 6.2% of his gross pay;

- Medicare tax that is 1.45% of his gross pay;

- State tax that is 19% of his federal tax.

Let's count:

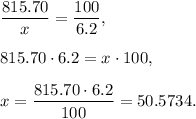

1. gross pay of $815.70 - 100%,

Social Security tax of $x - 6.2%.

Then

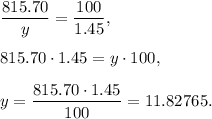

2. gross pay of $815.70 - 100%,

Medicare tax of $y - 1.45%.

Then

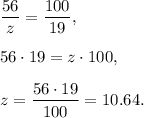

3. Federal tax of $56 - 100%,

State tax $z - 19%.

Then

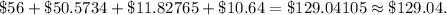

4. Chuck’s gross pay will be reduced by