Answer: First option is correct.

Step-by-step explanation:

Since we have given that

Income of Natalie makes per month = $2000

Amount She spends on credit card payments = $100

Amount she spend on an auto loan = $250

Total debt is given by

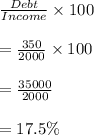

So, Debt-to-Income ratio is given by

Hence, First option is correct.