Answer:

Hence, the property tax of Susan is:

$ 893.75

Explanation:

The property of Susan is assessed at $ 27,500

Also, the property tax in her city is: 3.25%

This means that the property tax is 3.25% of Susan's property

i.e. 3.25% of 27500

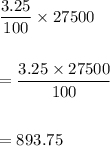

i.e. 3.25%×27500

Her property tax is:

$ 893.75