Answer:

The correct option is A.

Explanation:

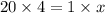

It is given that a country's debt-to-GDP ratio is currently 25%.

It is given that debt is expected to grow from $16 trillion to $20 trillion in the next 10 years.

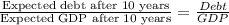

Let the expected GDP after 10 years to maintain the current debt-to-GDP ratio be x.

The expected GDP after 10 years to maintain the current debt-to-GDP ratio is $80 trillion .

Therefore the correct option is A.