Answer:

The effective rate is R=5.04%

Explanation:

Consider the provided information.

We need to find the effective rate of a $30000.

Interest Rate is 5% or 0.05.

Sometimes bankers calculate interest on a 360-day year for comfort.

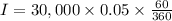

Therefore, I can be calculated as:

I = Principal x Interest Rate x Frequency of a year

Principal = 30000, Interest Rate = 0.05 and Frequency of a year = 60÷360

Thus, cash in hand at the beginning of 60 days is:

p = 30,000 − 250 = 29750

The effective rate can be calculated as:

or

R=5.04%

Hence, the effective rate is R=5.04%