Answer:

Monthly payment = $1,779.41

Step-by-step explanation:

A mortgage is a a form of loan that is secured on a specified property that the debtor with predetermined periodic payments over a fixed period of time.

Here is the formula for calculating Hugh's monthly repayment

![\\P[(r(1+r)^n)/(((1+r)^n)-1))]](https://img.qammunity.org/2018/formulas/business/college/xhfrujp882lnhj22kuafobhb836me9tg59.png)

Explanation of the terms below

- M = Monthly mortgage payment.

- r = Interest rate. Which has to be recalculated to monthly. Therefore monthly rate[5.9% expresssed in percentage] =

= 0.004917

= 0.004917 - n = number of payments. This is the loan term. Therefore our N = 30 years by 12 months = 360.

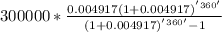

Fitting into the formular:

Which is = $1779.41 monthly