Answer:

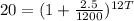

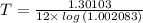

It take 119.954 years to earn $ 3000 without depositing any additional funds.

Explanation:

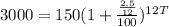

Given:

Principal Amount, P = $ 150

Amount, A = $ 3000

Rate of interest, R = 2.5% compounded monthly.

To find: Time, T

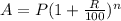

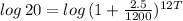

We use formula of Compound interest formula,

Where, n is no time interest applied.

Since, It is compounded monthly.

R = 2.5/12 %

n = 12T

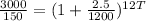

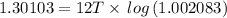

Taking log on both sides, we get

Therefore, It take 119.954 years to earn $ 3000 without depositing any additional funds