Given:

First payment = $800 due today

Second payment = $600 in 9 months

Interest rate = 10.5% compounded monthly

The interest is to be settled in a payment of $800 in 6 months and a final payment in 24 months.

Let's determine the final payment if the money is now worth 9.5% compounded quarterly.

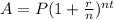

Apply the compound interest formula:

Let x represent the initial amount of debt.

Thus, we have the equation:

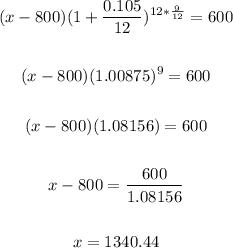

For the amount due in six months, we have:

Hence, the amount which is due after 6 months will be:

$1404.87 - $800 = $604.87

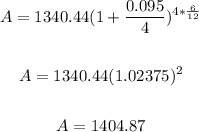

Now, let's find the payment due in 24 months.

Number of months remaining = 24 - 6 = 18 months.

Hence, we have:

Therefore, the final payment if the money is now worth 9.5% compounded quarterly is $696.35

ANSWER:

$696.35